Empower your teams to transform the way they work

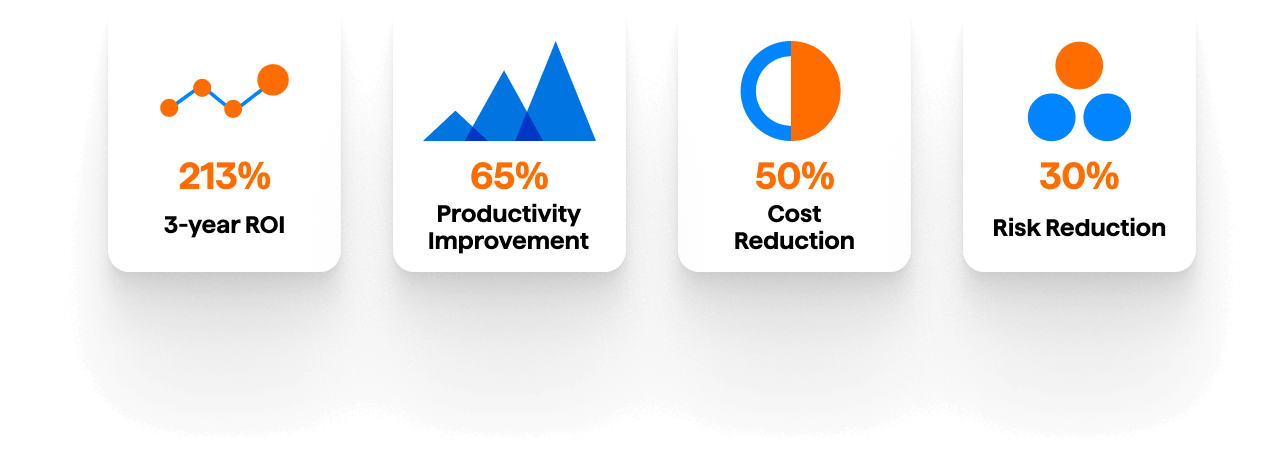

Digitally transform faster with Nintex’s easy-to-use and powerful intelligent process automation and workflow software.

Process Identification

Identify processes for automation and optimization

Learn moreProcess Management

Document, map, and manage every process in your organization

Learn moreWorkflow Automation

Cloud-based apps to connect people, process, and data

Learn moreApplication Development

Create workflows to connect data

Learn moreForms Automation

Digital forms for displaying or capturing data

Learn moreRPA

Automate manual, repetitive tasks with robotic process automation

Learn moreDocument Generation

Automate the lifecycle of documents in Salesforce

Learn moreAnalytics

Gain visibility and insight into your automated processes

Learn moreIdentify top use cases that companies are implementing

Nintex’s powerful platform can be adopted to a number of business processes…everything from employee onboarding to invoice booking. Investigate the possibilities.

How can process automation address your department’s priorities

See how Nintex’s Process Automation solutions can help across your business.

See what others in your industry are doing

See how you can use automation in your industry to improve productivity and efficiency.

Accelerate your Process Automation journey

Our process map, workflow, and RPA bot templates accelerate your company’s time to value and improve your ability to scale.

Achieve success with free workflow templates

With pre-built process maps, automation templates, workflows, RPA bot flows, and connectors, kickstarting your digital transformation journey has never been easier.

Pre-built Connectors

Connect to 3rd party products and software with ease

ViewProcess Companion

Pre-built process maps with process manager mobile app

ViewTransform the way your business operates